Additional lump sum payment mortgage calculator

You may also enter extra lump sum and pre-payment amounts. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current.

Mortgage Calculator For Extra Payments Clearance 55 Off Www Wtashows Com

An extra R250 payment in your R1 000 000 bond every month will shorten your bond repayment period by 15 years assuming a rate of 10.

. Average property tax in the United States is 138 of the assessed home value. Unbeatable Mortgage Rates for 2022. Using our lump sum repayment calculator you can estimate that a 25000 one-off payment into your home loan could shave 21 months and 17500 off your home loan.

By making a lump sum payment you will repay your loan 58 months earlier and save 961855 in interest charges over the remaining term of the loan. This adds 5500 to your monthly payments. Calculate Your Rate in 2 Mins Online.

Save thousands of pounds in interest charges. Make a One-Time Lump-Sum Contribution. Our mortgages section has lots more information on mortgages and paying extra off your mortgage.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. With just 200 per month you removed 6 years and two months off your. If you choose to pay down your mortgage you will have opportunity coststhe value of what your money could have done if you hadnt used it to pay down your mortgage.

People who use an Endorsed Local Provider ELP save an average of 731 a year on insurance premiums. Making a lump sum payment particularly in the early years of your loan can have a big effect on the total interest paid on the loan. Want to pay off your mortgage earlier or reduce your monthly payments.

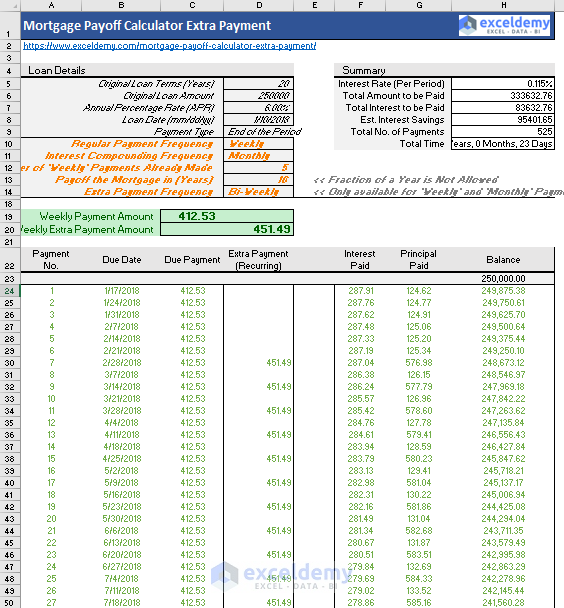

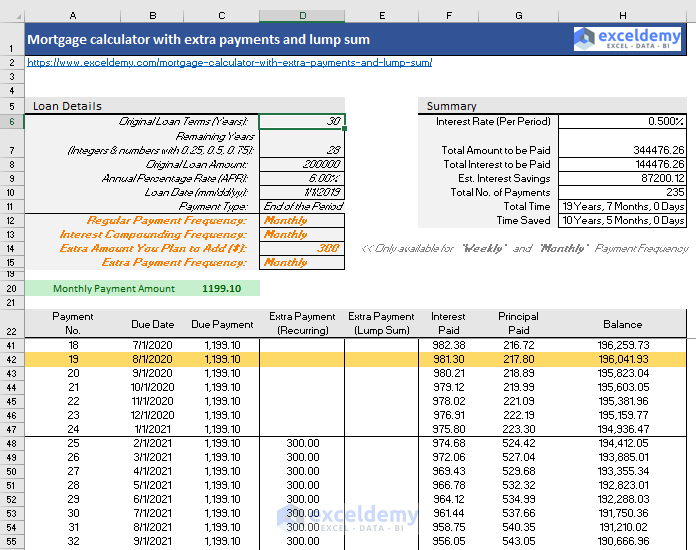

To learn what your monthly payment will be based on your home price interest and more use our mortgage calculator. Mortgage Calculator With Extra Payments Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total amount of. Notice when there is an additional payment the calculator uses 100 of the amount to reduce the balance.

Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa. Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa. We also generate graphs summaries of balances payments and interest over the life of your mortgage.

Use this calculator to compare the numbers and determine how much you can save. Normally when you make a lump sum mortgage payment that amount goes down in full on the principle. Apply Now With Quicken Loans.

Enter Current Loan Info Student Loan Balance Average Interest Rate Current Monthly Payment One-Time Extra Payment TOTAL SAVINGS 512 View Details Total Savings Go Back TIME SAVED. How Much Interest Can You Save By Increasing Your Mortgage Payment. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

This is the case even when you make the extra payment between the scheduled payment dates. According to the Monevator mortgage calculator youd. Ad Compare Mortgage Options Calculate Payments.

Making a lump-sum mortgage payment isnt your only option if youre fortunate enough to have extra money. Over 30-years would require you to make additional payments of around 2100 each month to cut the loan term down to 15 years. Ad Compare Top Mortgage Lenders 2022.

Making large early payments can reduce the interest charged o n your mortgage however this still varies between lenders - so be sure to ask your lender. Private Mortgage Insurance also known as Lenders Mortgage Insurance tends to be around 55 per month per 10000000 financed. However if you could pull this off you would save 360216.

Get The Service You Deserve With The Mortgage Lender You Trust. Property tax rate also known as millage tax varies from state to state. Ad Best Home Loan Mortgage Rates.

Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa. Additional Payment Calculator Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Here are some of the other things.

Compare Offers Apply. Why you should get pre-approved oobas pre-approval allows you to check your credit score and assess how much you can afford. Other Ways To Use Your Extra Cash.

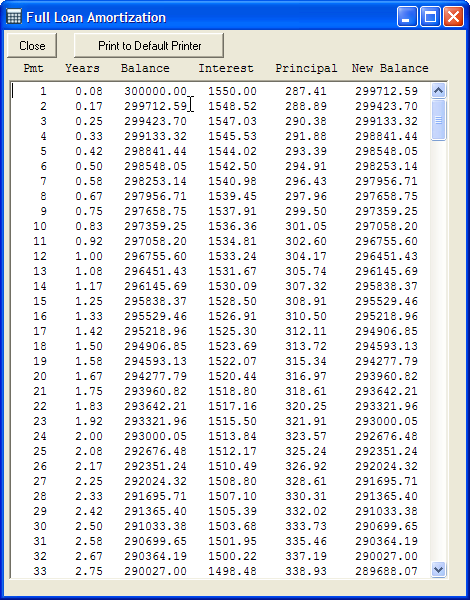

Get Pre-Qualified in Seconds. Extra Payment Mortgage Calculator to Calculate Mortgage Payoff Savings This free online mortgage amortization calculator with extra payments will calculate the time and interest you will save if you make multiple one-time lump-sum weekly quarterly monthly andor annual extra payments on your house loan. Extra mortgage payments calculator If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you could save and whether you can shorten the term of your mortgage.

This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage and the total interest paid. In addition to saving interest payment youll also repay the loan sooner freeing up extra cash at the end. If you are making extra payments you will want to use this calculator to verify that your lender applies the entire payment to principal.

Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. 27 rows Mortgage Calculator with Lump Sums This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. Here are a few key takeaways to consider before making extra and lump sum payments on your mortgage.

Make payments weekly biweekly semimonthly monthly. This lump sum extra payment calculator shows you how much money and time you can save when you make a lump sum payment or extra payment toward your student loans. Making additional payments on your home loan over and above the monthly compulsory minimum instalments which comprise of both interest and capital repayments goes straight towards reducing your capital.

Extra payments and lump sum payments are good options as they can reduce your loan term. This has the effect of reducing your loan term thus saving you interest if you continue to meet your monthly minimum home loan instalments. Get Your Estimate Today.

Extra Payment Mortgage Calculator For Excel

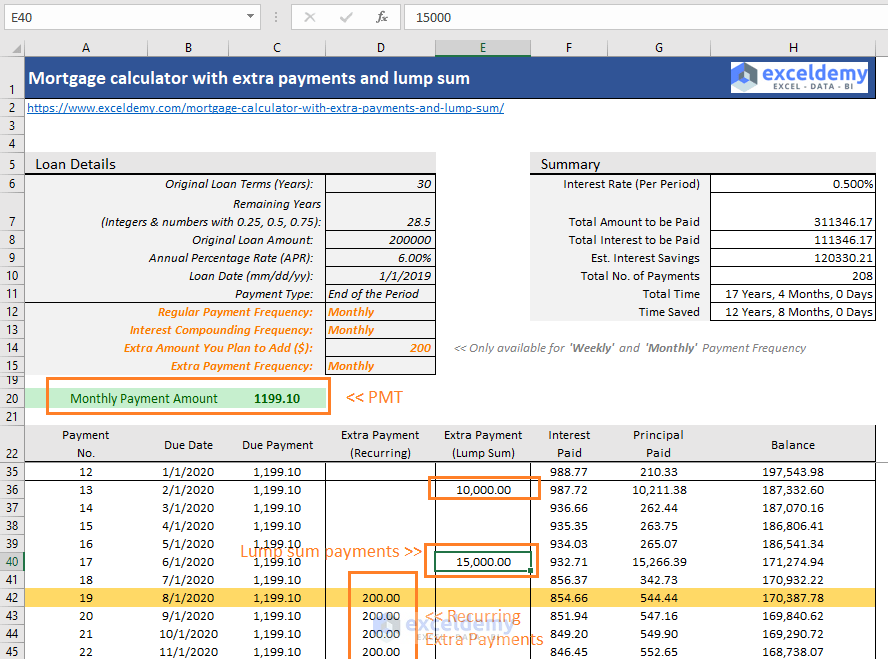

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

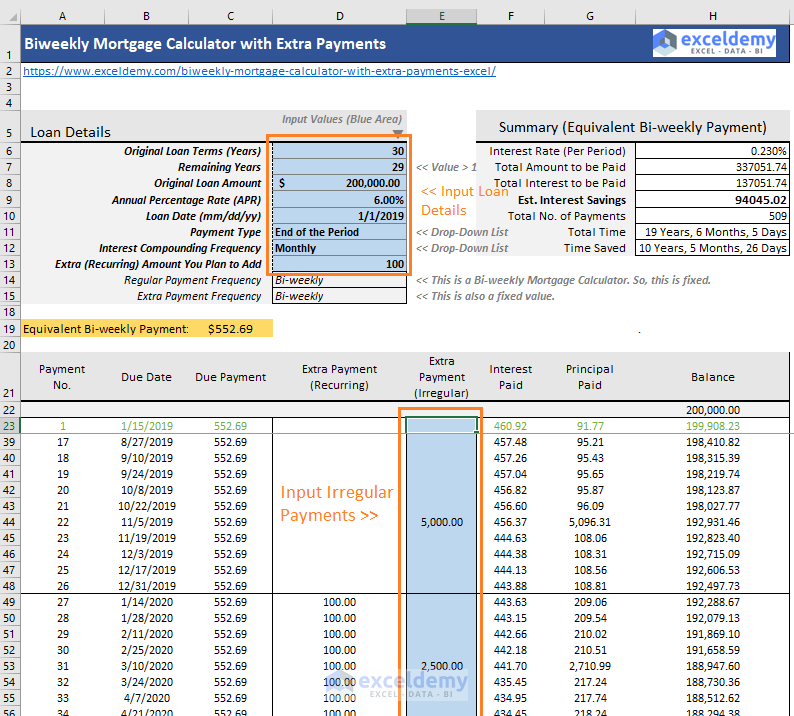

Biweekly Mortgage Calculator How Much Will You Save

Accelerated Debt Payoff Calculator Mls Mortgage Amortization Schedule Debt Payoff Mortgage Calculator

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Mortgage Calculator With Extra Payments Payment Schedule

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

How To Use A Mortgage Calculator Comparewise

Downloadable Free Mortgage Calculator Tool

Downloadable Free Mortgage Calculator Tool

Pin On Mortgage Calculator Tools

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

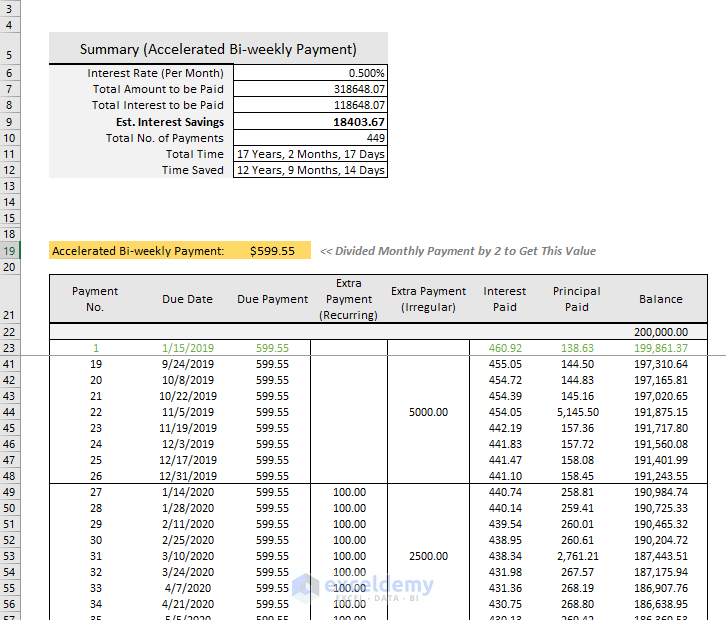

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

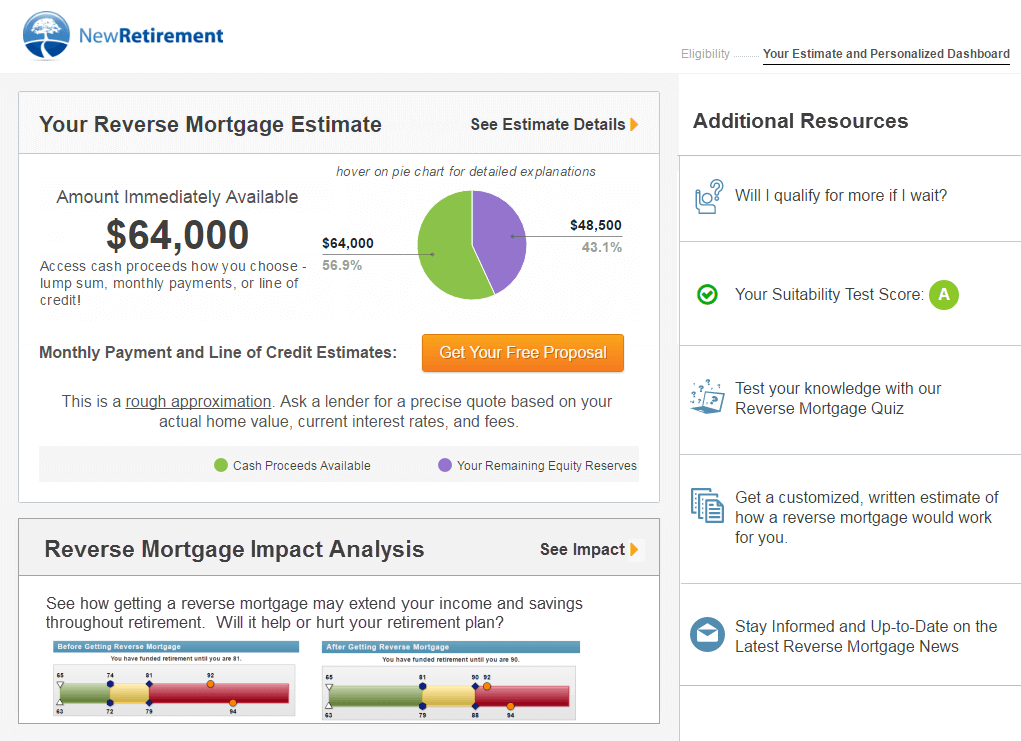

Reverse Mortgage Calculator How Does It Work And Examples

Biweekly Mortgage Calculator With Extra Payments Free Excel Template